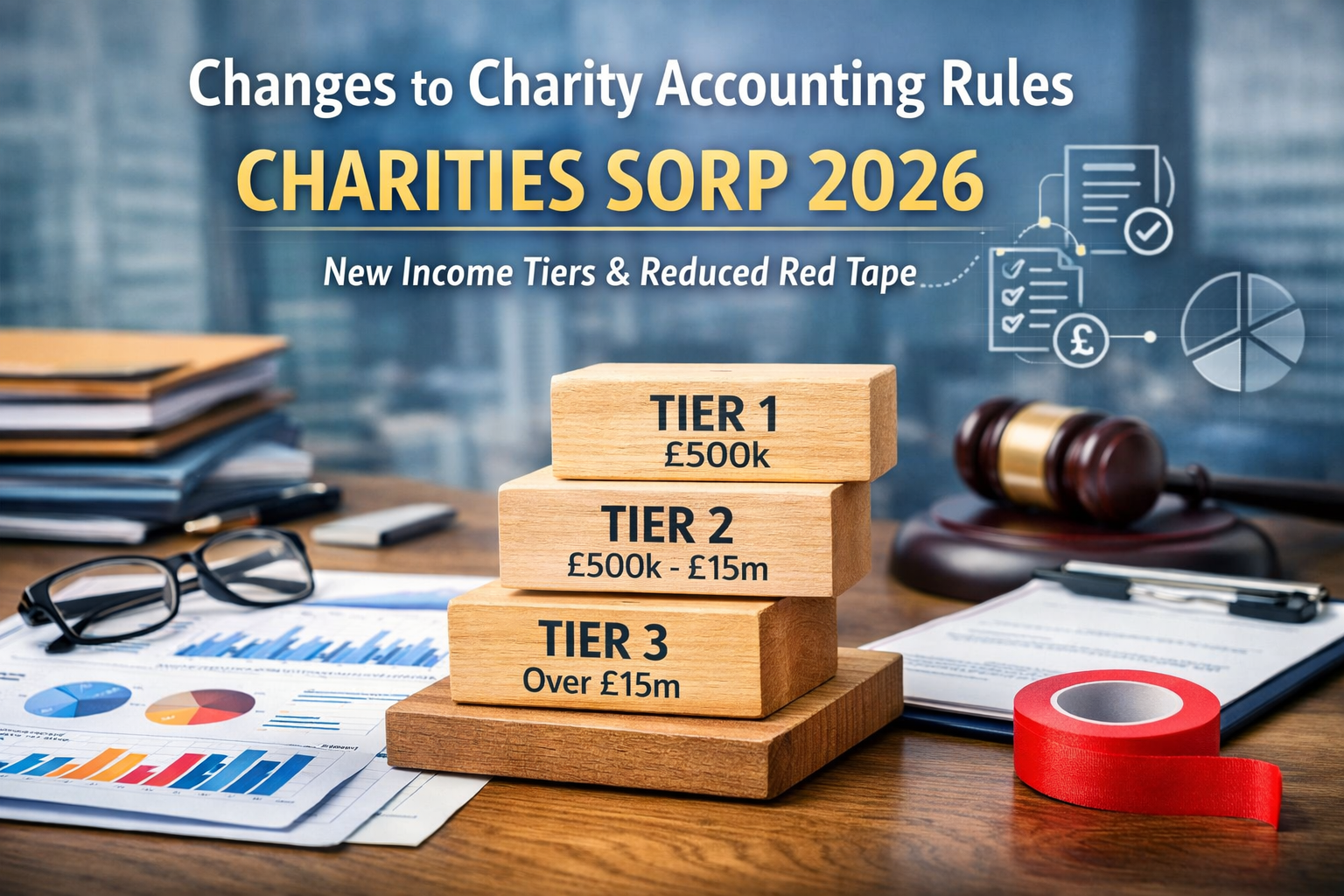

Changes to Charity Accounting Rules Come Into Effect: Charities SORP 2026

The UK’s charity accounting framework is undergoing a significant overhaul. The newly published Charities Statement of Recommended Practice: Accounting and Reporting by Charities (SORP 2026) will apply to financial reporting periods beginning on or after 1 January 2026, introducing a tiered structure tailored to charity size and aiming to reduce administrative burden for smaller organisations while enhancing transparency for larger ones.

Why the Update Matters

SORP 2026 stems from a joint effort by the charity regulators across England and Wales, Scotland and Northern Ireland — collectively the SORP-making body — to modernise charity financial reporting. The update reflects recent changes to the UK accounting standard FRS 102 and incorporates broader sector feedback from an extensive public consultation.

The primary objective of the new framework is to ensure that charity reporting is proportionate to organisational scale and complexity, thereby reducing unnecessary red tape for smaller charities while preserving robust disclosure for larger ones and key stakeholders.

Introduction of Three Income-Based Reporting Tiers

A central feature of SORP 2026 is the introduction of a three-tier reporting structure based on a charity’s gross income:

Tier 1: Charities with income up to £500,000

Tier 2: Charities with income between £500,000 and £15 million

Tier 3: Charities with income above £15 million

This tiered model replaces the previous approach and is designed to align reporting obligations with organisational capacity. Under the new regime, smaller charities will face fewer mandatory disclosures, reducing the time and cost associated with preparing detailed financial statements. Meanwhile, larger charities retain more comprehensive reporting requirements that reflect their scale and public interest profile.

Key Changes in SORP 2026

Beyond the tiered framework, SORP 2026 introduces additional changes that will reshape how charities prepare and present financial information:

1. Proportionate Financial Disclosure

Only Tier 3 charities — those with annual income over £15 million — and those that do not qualify as “small entities” under FRS 102 must prepare a detailed statement of cash flows, reducing complexity for charities with income up to £15 million.

2. Updated Income and Lease Reporting

SORP 2026 incorporates updated guidance on how charities account for specific income types and lease arrangements to reflect recent amendments to the FRS 102 standard. This includes sector-specific examples intended to aid practical application.

3. Refreshed Trustees’ Annual Report Requirements

The Trustees’ Annual Report (TAR) has been materially refreshed. Charities must now provide clearer disclosures on reserves, future plans and a broader narrative connecting financial performance with organisational impact. Dedicated sections and guidance on impact reporting, as well as environmental, social and governance (ESG) issues, are included to meet growing stakeholder demand for transparency.

4. Simplification for Smaller Charities

While the core SORP changes relate to accruals accounting, recent policy changes from the Department for Culture, Media and Sport (DCMS) suggest that some accounting thresholds will also rise — for example, the income threshold for accrual accounts may increase from £250,000 to £500,000, allowing more smaller charities to opt for simpler receipts and payments accounts, further reducing administrative requirements.

What This Means in Practice

For charity trustees, accountants and preparers, the introduction of SORP 2026 represents both a compliance challenge and an opportunity:

Smaller charities can benefit from reduced disclosure requirements and lower reporting burden, allowing them to focus more on core mission delivery and governance.

Larger charities will need to invest in expanded narrative reporting and enhanced governance disclosures that articulate impact and long-term sustainability strategies.

All charities should review how their income streams and lease arrangements are recognised under the new standard and ensure systems and processes are updated ahead of the first applicable reporting period.

Practical Steps for Charities

Charity trustees and finance teams should:

Determine the tier your charity falls into

Review income recognition and lease accounting practices

Update TAR templates for narrative and ESG disclosures

Engage auditors or independent examiners early to ensure compliance

By preparing early, charities can avoid last-minute compliance challenges and focus more resources on their core mission.

The SORP 2026 reforms are a positive step toward proportionate charity reporting. Smaller charities benefit from reduced red tape, while larger charities maintain accountability and stakeholder confidence.

For UK charities, early adoption and understanding of the new income tiers will simplify reporting and improve financial governance.